Vancouver WA Real Estate information and resources for the home seller or home buyer looking to be better informed.

Wednesday, August 21, 2019

Building Equity through Home Ownership

Equity build-up could be one of the biggest advantages to buying a home. There are two distinct dynamics that take place to make this happen: each house payment applies an amount to reduce the mortgage owed and appreciation causes the value of the home to go up.

It is easy to make a projection based on the type of mortgage you get and your estimation of appreciation over the time you expect to own the home. Even conservative estimates can produce impressive results.

Let's look at an example of a home with a $270,000 mortgage at 4.5% for 30 years and a total payment of $2,047.55 payment including principal, interest, taxes and insurance. The average monthly principal reduction for the first year is $362.98. If you assume a 3% appreciation on the $300,000 home, the average monthly appreciation is $750 a month.

The total payment of $2,047.55 less $1,112.98 for principal reduction and appreciation makes the net monthly cost of housing, excluding tax benefits, $934.57. If this hypothetical person was paying $2,500 in rent, it would cost them $1,565.43 more to rent than to own. In the first year, it would cost them over $18,000 more to rent.

Together, the items in this example contribute over $1,100 to the equity in the home . This is one of the reasons a home is considered forced savings. By making your house payments and enjoying increases in value, the equity grows and the net cost of housing decreases by the same amount.

In this same example, the $30,000 down payment grows to $133,991 in equity in seven years. While this is equity build-up, the extraordinary growth is attributed to leverage. Leverage is an investment principle involving the use of borrowed funds to control an asset.

To see what your net cost of housing and the effect of leverage will have on a home in your price range, see the Rent vs. Own. If you have questions or need assistance, ontact Equity build-up could be one of the biggest advantages to buying a home. There are two distinct dynamics that take place to make this happen: each house payment applies an amount to reduce the mortgage owed and appreciation causes the value of the home to go up.

It is easy to make a projection based on the type of mortgage you get and your estimation of appreciation over the time you expect to own the home. Even conservative estimates can produce impressive results.

Let's look at an example of a home with a $270,000 mortgage at 4.5% for 30 years and a total payment of $2,047.55 payment including principal, interest, taxes and insurance. The average monthly principal reduction for the first year is $362.98. If you assume a 3% appreciation on the $300,000 home, the average monthly appreciation is $750 a month.

The total payment of $2,047.55 less $1,112.98 for principal reduction and appreciation makes the net monthly cost of housing, excluding tax benefits, $934.57. If this hypothetical person was paying $2,500 in rent, it would cost them $1,565.43 more to rent than to own. In the first year, it would cost them over $18,000 more to rent.

Together, the items in this example contribute over $1,100 to the equity in the home . This is one of the reasons a home is considered forced savings. By making your house payments and enjoying increases in value, the equity grows and the net cost of housing decreases by the same amount.

In this same example, the $30,000 down payment grows to $133,991 in equity in seven years. While this is equity build-up, the extraordinary growth is attributed to leverage. Leverage is an investment principle involving the use of borrowed funds to control an asset.

To see what your net cost of housing and the effect of leverage will have on a home in your price range, see the Rent vs. Own. If you have questions or need assistance, please feel free to contact me.

Friday, August 16, 2019

Clark County WA Homes For Sale - July 2019

Home Sales Relatively Strong for Clark County WA this July 2019.

With more than half of the year behind us we are seeing a relatively strong summer season but, not yet strong enough to have unit-sales catch up to last year's level. With Inventory still quite low, prices have hit another high. Here are the key points for this month:

- Average-Sales Price hit a new high, with the 12-month/long-term

trend line up 3.98% year-over-year; with the 3-Month Moving Average up

1.98% from this time last year;

- The Inventory for Resale Real Estate remained unchanged at a low 2.2 Months

of Supply;

- Approximately 678 Resale Properties closed in the month, which is about 11 fewer

(-1.6%) homes than in 2018; and 30 more than last month;

- REO/Bank Owned property sales were 0 units (0% of total); down from 3 (0.4%) in 2018;

- Short Sale /Pre-Foreclosure property sales were 2 units (0.3% of total); down from 3 (0.4%) in 2018.

For Home Mortgage interest rates the month-end, 30-year-fixed loan interest rate

(nationwide average) is 3.77% (Down

from 3.80% last month) according to Freddie Mac; compared to 4.53% for July 2018.

The current rate level is now very close to the all-time low!

The custom Unit-Volume (number of properties sold) chart up next show the short term (in

Red) and

long term (12-month moving average in

Blue) trends:

The Short-term trend line is moving up strongly, enough so that the Long Term

line has started to turn upward modestly.

The next chart for the Average Home Sales Price trends,

illustrating the results in both the short-term and long-term:

Like we typically see each summer, sales prices are in the peak-area for the

year. This time the difference between last year's peak is not as great as we've

seen in prior years. With home loan rates at such a low level, and

Inventory so low, the pressure in sales prices remains strongly in place for

now.

The

Average (using 3 months) sales price for Clark County is now $409,245;

which is an increase of

approximately $7,944 from

this time last year.

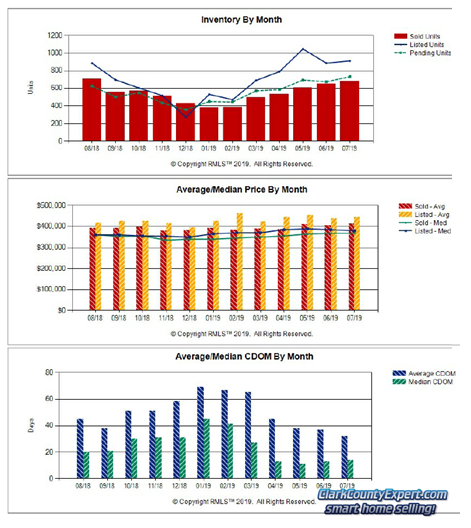

These remaining charts come from RMLS and show:

New Listings

gained slightly from last month, with Pending Sales and Closed Sales

both moving up as well; as a result there was no change to the level of

Inventory.

The second graph

shows both Average List and Sales Prices turning in strong results.

Lastly, Average Days

on market declined by several days; while Median Days on the Market increased

slightly.

We've also made

available the

recent RMLS published report on

the Clark County real estate scene, and you can find it here:

RMLS Market Action Report on our

main website.

Thank you for visiting our Home Sales report for Clark

County WA; and please let us know if

you have any questions or need help with your home or condo!

PS - The home sales market is in change-mode as prices are

softer with loan costs now falling, keeping this an excellent time to List and Sell Your

Home with Our

Team; or, at least find

out what your property is worth! We offer a no-cost, no-obligation

Clark County WA Home Valuation, and invite you to try it out!

PPS -

Looking to buy a house reasonably soon? Interest rates have been falling

and are still at historically

low rates. You are invited to visit our web-page for

Clark County WA Homes For Sale where it is Quite Easy to search by City,

Neighborhood or by Category, with homes and real estate listings from the entire

RMLS. Sign-up Not Required! The property and home listings shown are

provided via many updates each day, and you will be e-mailed hourly with any new

matches once you've signed up for a home search.

We also have the MLS

Listings for these great towns in Clark County:

Battle Ground WA Real Estate For Sale |

Brush Prairie WA Homes For Sale |

Camas WA Homes for Sale |

Hockinson WA Homes For Sale |

La Center WA Homes for sale |

Ridgefield WA Homes for sale |

Real Estate for sale in Vancouver Washington |

Washougal WA Real

Estate |

Yacolt WA Homes For Sale |

Amboy WA Homes For Sale

The information and charts in this Clark County WA real estate update (prepared by

Vancouver WA Home Sales Broker, John Slocum, CRS, SFR, our resident statistician) are based on home sales recorded in the

Clark County WA MLS system (RMLS), excluding sales of mobile home; and shows the purchase activity since 2009; charting the 3 month Moving average number of sales, and the 12 month Moving average. This "smoothing" of the trend-data helps illustrate the short-term and longer term trends in Clark County's real estate market.

Disclaimer: as with any real estate statistics, we do our best to provide the best representation at the time the data was acquired

and compiled. The data and reports are deemed reliable but not guaranteed.

Monday, August 12, 2019

Types of Real Estate in Vancouver WA and Income Tax Considerations

Principal Residence ... a principal residence is the place a person lives or expects to return if they are temporarily away from it. It could be a single family, detached home or condominium or a duplex, tri-plex or four-unit. The owner(s) can deduct the qualified mortgage interest and property taxes on the schedule A of their tax return. There is a capital gains exclusion on profit of up to $250,000 for a single taxpayer and up to $500,000 for a married taxpayer.

Income Property - is improved property that is rented or leased to tenants as opposed to using it personally. It can include houses and condos, apartment buildings, office complexes, shopping centers, warehouses and other commercial buildings. Depreciation is allowed on the improvements. For property held more than one year, the profits are taxed at long-term capital gains rates. This type of property is eligible for a tax deferred exchange.

Investment Property ... can be raw land or improved property that is not rented or leased. This property is not subject to depreciation. If the property is held for more than one year, the profits are taxed at long-term capital gains rates. It is also eligible for a tax deferred exchange.

Dealer Property ... this type of property is primarily considered inventory because the intention is to sell it without intentionally holding it for more than a year. It could be new construction such as a home builder. It could be an investor who buys a property and expects to sell it for more. There is not a requirement to make improvements. The profits on dealer property are taxed as ordinary, "sweat of the brow" income. Dealer properties cannot be exchanged.

A second home is like a principal residence in that you can deduct the interest and property taxes on your Schedule A, up to the limits. A second home, as well as a principal residence, can be rented out up to 14-days a year without threatening the status of the property. Seconds homes are not eligible for exchange because personal use properties are not allowed. A second home is not a principal residence and profits are taxed like an investment property. If you own it for more than a year, it is taxed at long-term capital gains rates.

Vacation homes are rented for more than 14 days a year and are like income property but with some additional rules that apply. If your personal use is 14 days or less or 10% of the time it is rented, your expenses can be deducted in excess of income. If you use it for more than 14 days or more than 10% of the number of days it is rented, it is considered personal use and your expenses are limited to the amount of income collected with no losses being deductible.

Taxpayers can strategically change the property type based on their intentions. A principal residence can be converted to income property. Dealer property could become a principal residence. A rental property could become a principal residence.

Professional tax advice is always recommended to be able to understand the information and how it applies to your specific situation.

When it comes to purchasing or selling most any of the types of properties listed above, we at our team are happy and capable to help you - just let us know!

Some helpful real estate resources for the Vancouver Washington area:

Homes for sale in Vancouver WA

Luxury Homes for sale in Vancouver WA

Condos for sale in Vancouver WA

Commercial Real Estate for sale in Vancouver WA

Thursday, August 1, 2019

Not In A Flood Zone? You May Still Want Flood Insurance!

Here in the Vancouver Washington and Pacific Northwest area we have many Rivers, Streams and Lakes, with the documented Flood Zones requiring property owners within those zones to have Flood Insurance Coverage.

Not too well known however, is that it is very possible to not be within a Flood Zone, and have Flooding Damage to your home. In fact like the graphic above shows nationwide more than 20% of the flood claims come from properties that are not in a designated flood zone.

Water can come into the living area of a home from many sources, and a small amount can cause significant, expensive-to-repair damage. However, a standard homeowners insurance policy will only cover certain events such as a burst plumbing pipe or fixture within the home; while a backed-up storm drain that floods your home will not be covered.

Can you think of the times when a strong thunderstorm rolls through our area and dumps an inch or two of rain rather quickly? When our rainwater management systems are designed for precipitation quantities of about one-inch or less per day, the extra and rapid dumping of rain from a thunderstorm can quickly flood yards, streets, and can come quickly down hillsides and possibly end up in your home! This would be considered flood water, and any damage it causes to your property would only be covered with flood insurance.

In addition to considering flood insurance, it is also to keep an eye out for physical preventative measures you may be able to take to make it harder for flood water to enter your home. Two common places to check and perhaps remedy are: 1) Crawlspace vents that are at, or below grade; and 2) Downspouts and where their out-flow goes.

Crawlspace vents that are at or below grade are a somewhat common finding we see during a Home Inspection. These are necessary vents for a healthy home but, we must make certain it is very difficult for rain and groundwater to enter those vents.

The Gutter + Downspout system that is working correctly is also on the front-line of defense. Keeping the gutters clean, downspouts working, with the final delivery of the rainwater away from the home, in a manner the water will stay away from the home - is essential.

In sum, this article is not meant to be definitive or contain enough information to help you determine if you should buy flood insurance but rather, raise awareness enough that you'll check with your local insurance agent, and perhaps other resources available on the Web.

Additional Resources that may help you to learn more about this topic:

From FEMA: Your Homeowners Insurance Does Not Cover Flooding and

Facts and Myths about Flood Insurance

Dave Ramsey: Do I Need Flood Insurance?

Bankrate: All Wet! 6 Flood Insurance Myths Debunked

PS - If you are looking to Sell or Buy a Home in Vancouver Washington please check us out at: www.ClarkCountyExpert.com.