Real Estate Closed Sale Prices rise slightly; with Unit Sales Slowing being Constrained by Lack of Inventory for Clark County WA in January 2022.

Sales Prices rose modestly to achieve another new High. Seasonally we expect the number of Units-Sold per-month to be falling - although this year's number is much less than last year's - very likely due to the greatly reduced available Inventory for home buyers to shop. Here are the highlights for this month:

- Average-Sales Price moved up just over $4k+ finishing up at $555,946; with the 12-month/long-term

trend line up 18.48% year-over-year; and the 3-Month Moving Average up

18.05% from this time last year;

- The Inventory for Resale Property moved up only 0.1 Month's worth, ending at

the super-low 0.3 Month's worth of Supply;

- Approximately 390 Resale Properties were sold/closed, which is about 42 less (9.72%) properties than in 2021; and

276 fewer than last month;

- REO/Bank Owned property sales were 0 units (0% of total); down from 2 (0.46%) in 2021;

- Short Sale /Pre-Foreclosure property sales were 0 units (0% of total); no change from 0 (0%) last year.

The Freddie Mac's report on the 30-year-fixed mortgage loan interest rate

(nationwide average) at month-end, rose strongly ending at a monthly average of

3.45% ; compared to

2.74% for January 2021. Rates have risen strongly this first month of the year,

and are expected to have continued upward pressure in the near term.

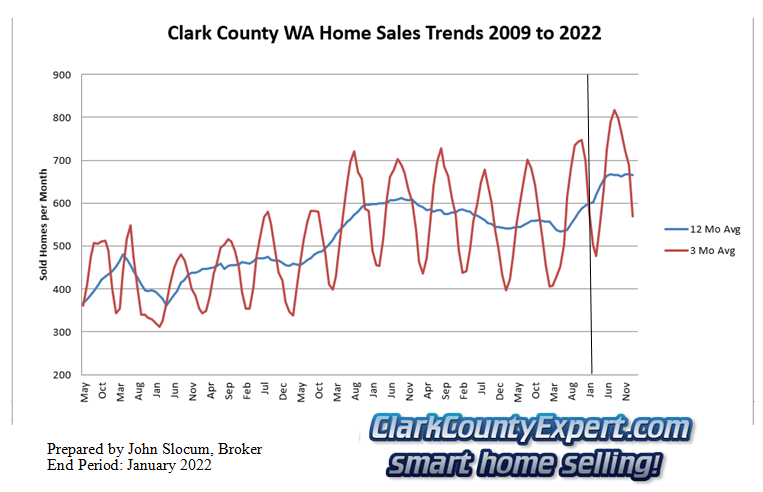

Next up is a Custom Chart (below) I created to show

Property-Sales Unit-Volume (number of

properties sold)

with short term (in

Red) and

long term (12-month moving average in

Blue) trends:

The short-term trend is both in the stronger-part of its seasonal decline,

compounded by the much lower level of closings seen from the dearth of

Inventory. The long-term trend-line is stubbornly in a plateau however, this

cannot last much longer at a continued slower pace of sales. This month's sales

for the County is behind last year's total home sales by 42 properties (-9.72%).

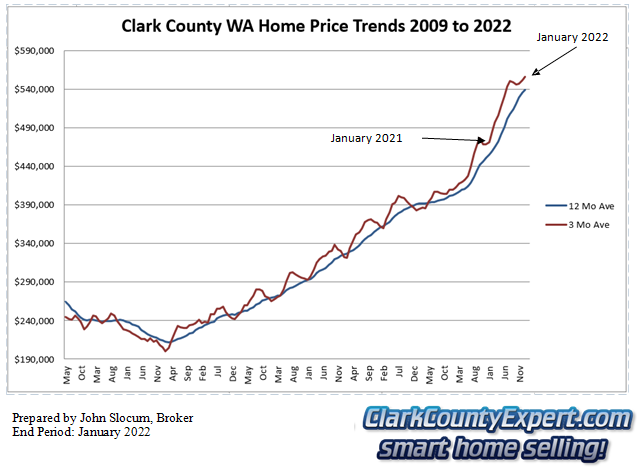

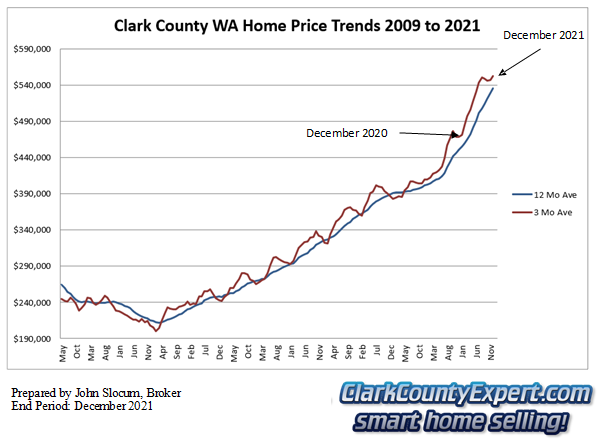

Continuing on is my chart showing the Average Real Estate Sales Price, the short-term

line climbing slightly to a new high; with the long-term trend also moving up to a new high:

Clearly Prices over the past 12 months have risen strongly overall at a pace

not far under 20%. With Interest rates jumping up recently, we expect prices to

be facing stronger headwinds in the near-term.

Clark

County's

Average Residential Property Sales Price (using the most recent 3 months) is now $555,946;

which is approximately $85,025 (+18.05%) higher than this time last year.

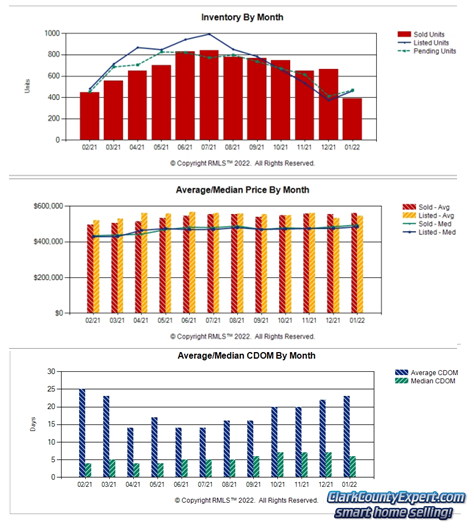

The remaining

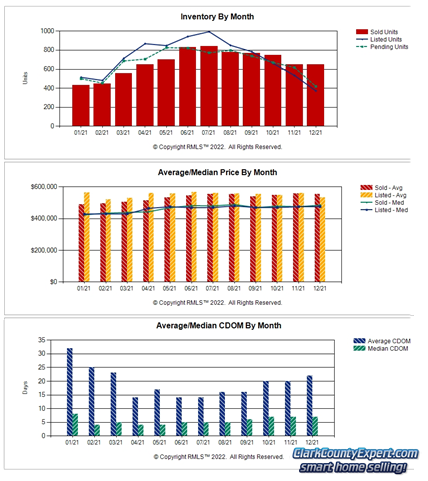

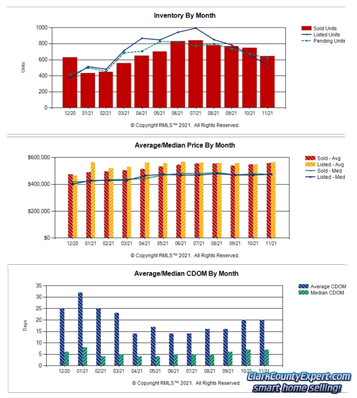

collection of graphs for this real estate sales report come from RMLS and show:

New Listings and Pending Sales both rose at about the same pace this month; with Closed Sales

quite a bit lower than the previous month.

With New Listings not moving up strongly so far, Active Inventory only

moved slightly up to 0.3 month's of supply.

The second graph shows the Average Price for Closed Sales

hitting a new high; and the Average Listing Price coming in modestly below that

number.

Finally, the Average Days on Market increased by

1 day finishing at 23 days; and Median Days on Market

fell one day ending at 6 days. The pace of this market is still quick for this

typically slower time of year.

Thank you for visiting our

Real Estate Market Report for Clark

County WA. Please let me know if

you have any questions or need help with your home or condo sale or purchase in

2022!

PS - The real estate market is changing, prices are

still rising, with loan costs now Rising, this may be an excellent time to List and Sell Your

Property with Our

Team; or, at least find

out what your property is worth! We offer a no-cost, no-obligation

Clark County WA Property Valuation, and invite you to try it out!

PPS

- Looking to buy a property reasonably soon? Interest rates are still at historically

low rates. You are invited to visit our web-page for

Clark County WA Real Estate For Sale where it is Quite Easy to search by City,

Neighborhood or by Category, with homes and real estate listings from the entire

RMLS. Sign-up Not Required! The property and home listings shown are

provided via many updates each day, and you will be e-mailed hourly with any new

matches once you've signed up for a home search.

We also have the MLS

Listings for these great towns in Clark County:

Battle Ground WA Real Estate For Sale |

Brush Prairie WA Homes For Sale |

Camas WA Homes for Sale |

Hockinson WA Homes For Sale |

La Center WA Homes for sale |

Ridgefield WA Homes for sale |

Real Estate for sale in Vancouver Washington |

Washougal WA Real

Estate |

Yacolt WA Homes For Sale |

Amboy WA Homes For Sale

The information and charts in this Clark County WA real estate update (prepared by

Clark County WA Real Estate Sales Realtor, John Slocum, SFR, our resident statistician) are based on home sales recorded in the

Clark County WA MLS system (RMLS), excluding sales of mobile home; and shows the purchase activity since 2009; charting the 3 month Moving average number of sales, and the 12 month Moving average. This "smoothing" of the trend-data helps illustrate the short-term and longer term trends in Clark County's real estate market.

Disclaimer: as with any real estate statistics, we do our best to provide the best representation at the time the data was acquired

and compiled. The data and reports are deemed reliable but not guaranteed.